Debt recycling is a financial strategy that is gaining popularity among savvy investors. By understanding the concept and mechanics of debt recycling, individuals can effectively leverage their debt to create long-term prosperity. In this article, we will explore the basics of debt recycling and its role in wealth creation. We will also delve into the benefits of debt recycling and the risks and challenges that it entails. Lastly, we will provide strategies for effective debt recycling, including tips for success and optimizing financial growth.

Understanding the Concept of Debt Recycling

Debt recycling is a strategy that involves utilizing the equity in your property to invest in income-generating assets. It allows individuals to convert non-deductible debt, such as a mortgage, into deductible debt, which can potentially reduce taxable income. The ultimate goal is to use the income generated from the investments to repay the non-deductible debt, thereby recycling the debt and increasing overall wealth. Lets explore further that is debt recycling worth it?

Debt recycling is a concept that has gained popularity among individuals looking to optimize their financial situation. By strategically leveraging the value of their property, they can unlock opportunities for further wealth creation. This strategy is not only about managing debt but also about making smart investment decisions that can lead to long-term financial success. Click here for guide to successful debt recycling.

The Basics of Debt Recycling

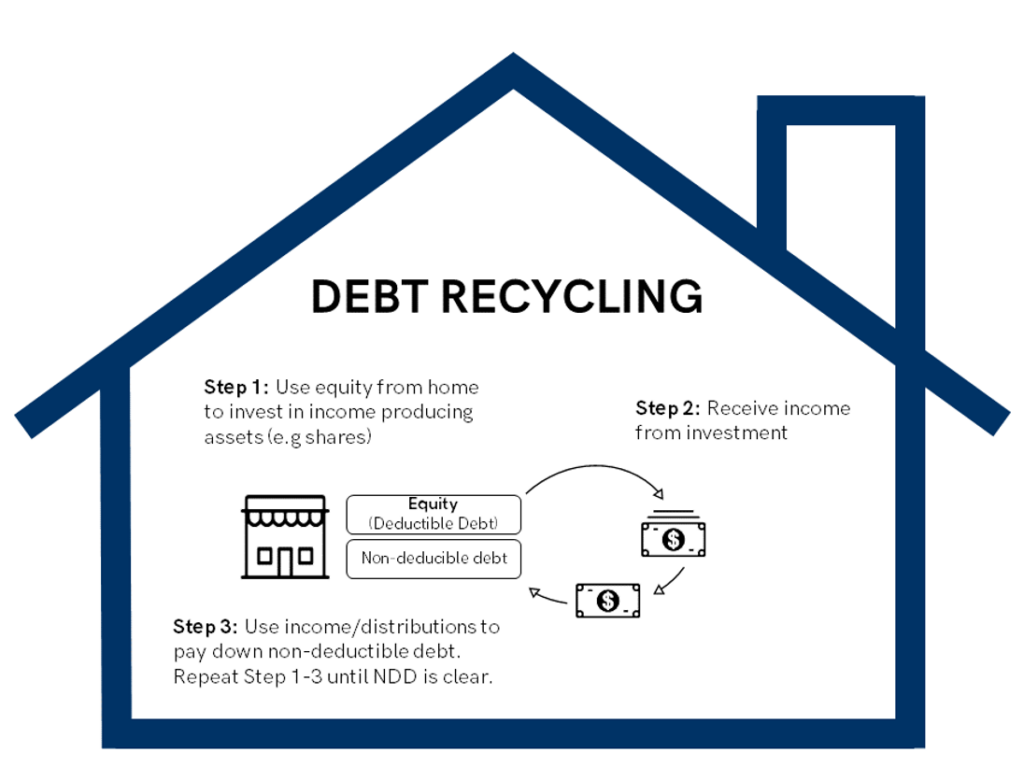

At its core, debt recycling involves three key steps. First, you use the equity in your property to obtain a line of credit, often referred to as a debt recycling loan. This line of credit provides you with the funds needed to invest in income-producing assets. It’s important to carefully assess your property’s equity and determine the appropriate amount to borrow.

Once you have secured the line of credit, the second step is to strategically invest in income-generating assets. These assets can include shares, property, or other investment vehicles that have the potential to generate a steady stream of income. It’s crucial to conduct thorough research and seek professional advice to ensure you make informed investment choices.

The third step in the debt recycling process is to redirect any income generated from your investments towards paying down your non-deductible debt. This can involve making regular repayments on your mortgage or other forms of non-deductible debt. By consistently allocating a portion of your investment income towards debt repayment, you can gradually reduce your non-deductible debt and increase your overall financial stability.

Debt recycling is not a one-time event but rather an ongoing process. By repeating these steps, you continually recycle your debt and maximize your wealth creation potential. It’s important to regularly review your investment portfolio and make adjustments as needed to ensure that you are on track to achieve your financial goals.

The Role of Debt Recycling in Wealth Creation

Debt recycling plays a vital role in long-term wealth creation. By strategically using the equity in your property and investing in income-generating assets, you can potentially create a source of passive income. This income can then be used to accelerate the repayment of your non-deductible debt.

As you continue to recycle your debt and reduce your non-deductible debt, your net worth can increase significantly. The ability to generate passive income from your investments provides you with financial flexibility and options. It can open doors to new opportunities, such as early retirement or pursuing your passion projects without financial constraints.

Furthermore, debt recycling can contribute to your overall financial independence. By reducing your reliance on non-deductible debt and increasing your investment income, you become less vulnerable to economic fluctuations and financial uncertainties. This can provide you with a sense of security and peace of mind, knowing that you have built a solid foundation for your financial future.

In conclusion, debt recycling is a powerful strategy that allows individuals to leverage the equity in their property to invest in income-generating assets. By following the steps of obtaining a line of credit, investing strategically, and using investment income to repay non-deductible debt, individuals can continuously recycle their debt and increase their overall wealth. Debt recycling plays a crucial role in long-term wealth creation and financial independence, providing individuals with the opportunity to achieve their financial goals and secure their future.

The Mechanics of Debt Recycling

Now that we understand the concept of debt recycling, let’s dive into its mechanics. It’s crucial to grasp how debt recycling works and the process involved in implementing this strategy effectively.

Debt recycling works by utilizing your property’s equity to access funds for investment purposes. This equity can be tapped into through a line of credit, which is often secured against the value of your property. The borrowed funds are then used to acquire income-generating assets, which generate a return on investment in the form of rent, dividends, or capital gains. The income generated from these investments is then used to repay the non-deductible debt, ultimately recycling the debt.

The process of debt recycling begins with an evaluation of your property’s equity and determining the amount that can be accessed through a line of credit. Once this is established, you can start exploring investment opportunities that align with your financial goals and risk tolerance.

When evaluating investment opportunities, it’s important to consider various factors such as the potential for growth, the stability of the market, and the expected returns. Conducting thorough research and seeking professional advice can help you make informed investment decisions.

Once you have identified suitable investment options, you can proceed with acquiring the income-generating assets using the borrowed funds. These assets can include real estate properties, stocks, bonds, or even businesses. The key is to choose investments that have the potential to generate consistent income over time.

As the income from these investments starts to flow, it can be directed towards paying off your non-deductible debt. By consistently using the income to reduce your debt, you are effectively recycling the debt. This process allows you to leverage your property’s equity to create long-term prosperity.

It’s important to note that debt recycling requires discipline and careful financial management. Monitoring the performance of your investments, adjusting your strategy as needed, and staying on top of your debt repayment schedule are essential for success.

In conclusion, debt recycling is a powerful strategy that allows you to leverage your property’s equity to acquire income-generating assets. By using the income from these investments to repay non-deductible debt, you can effectively recycle the debt and create long-term wealth. However, it’s crucial to approach debt recycling with caution and seek professional advice to ensure you make informed decisions that align with your financial goals.

The Benefits of Debt Recycling

Debt recycling offers several financial advantages and can contribute to long-term prosperity for individuals who implement it effectively.

When it comes to managing finances, debt recycling is a strategy that can provide individuals with a range of benefits. By understanding and utilizing this approach, individuals can take advantage of potential tax benefits, diversify their investment portfolio, and pave the way for long-term prosperity.

Financial Advantages of Debt Recycling

One notable benefit of debt recycling is the potential tax benefits it can provide. By converting non-deductible debt into deductible debt, individuals may reduce their taxable income and potentially save on tax payments. This means that individuals can redirect the money saved from taxes towards other financial goals, such as paying off debt faster or investing in income-generating assets.

Furthermore, debt recycling allows individuals to diversify their investment portfolio. By using the funds generated from the investments, individuals can explore different investment opportunities and spread their risk. This diversification can help protect against potential losses and potentially achieve higher returns over time.

Long-Term Prosperity through Debt Recycling

Beyond the immediate financial advantages, debt recycling can pave the way for long-term prosperity. By continuously recycling debt and investing in income-generating assets, individuals can create a sustainable source of passive income. This income can support a comfortable retirement, fund future investments, or contribute to achieving other financial goals.

Moreover, debt recycling allows individuals to take control of their financial future. By actively managing their debt and investments, individuals can build a solid financial foundation that can withstand economic fluctuations and unexpected expenses. This sense of financial security can provide peace of mind and allow individuals to focus on other aspects of their lives without constantly worrying about their financial well-being.

Additionally, debt recycling can also provide individuals with the opportunity to learn and grow their financial knowledge. By engaging in the process of analyzing and strategizing their debt and investments, individuals can gain valuable insights into financial management and develop skills that can be applied to other areas of their lives.

In conclusion, debt recycling offers numerous financial advantages and can contribute to long-term prosperity. By taking advantage of potential tax benefits, diversifying their investment portfolio, and continuously recycling debt, individuals can create a solid financial foundation and pave the way for a secure and prosperous future.

Risks and Challenges in Debt Recycling

While debt recycling offers significant potential benefits, it’s important to be aware of the risks and challenges associated with this strategy.

Potential Pitfalls of Debt Recycling

One of the main risks of debt recycling is the potential for a decline in the value of your investments. If your investments underperform or experience a downturn, it may impact your ability to generate sufficient income to repay the non-deductible debt. Additionally, there is always a level of risk associated with borrowing against the equity in your property, as changes in interest rates or property market conditions can affect the feasibility of the strategy.

Managing Risks in Debt Recycling

To effectively manage the risks in debt recycling, it’s crucial to remain vigilant and proactive. Regularly reviewing your investment portfolio and adjusting your strategy when necessary can help mitigate potential risks. It’s also essential to maintain a comprehensive understanding of your financial circumstances and ensure you have a contingency plan in case of unexpected changes in the market.

Strategies for Effective Debt Recycling

To make the most of debt recycling and achieve long-term prosperity, it’s important to employ effective strategies.

Tips for Successful Debt Recycling

First and foremost, it’s crucial to seek professional advice before implementing debt recycling. Financial advisors can provide tailored guidance based on your specific circumstances and help you navigate potential pitfalls. Additionally, conducting thorough research and understanding different investment options can help you make informed decisions and select the assets that align with your objectives. Regularly monitoring and reassessing your investments is also vital to ensure they continue to generate the desired income and contribute to the repayment of your non-deductible debt.

Optimizing Debt Recycling for Financial Growth

To optimize debt recycling for financial growth, it’s essential to strike a balance between risk and reward. Diversifying your investment portfolio across different asset classes and sectors can help spread risk and potentially enhance returns. Additionally, continuously educating yourself about investment strategies, market trends, and financial management can empower you to make informed decisions and adapt your strategy as needed.

In conclusion, debt recycling is a powerful financial strategy that can benefit individuals looking to leverage their debt for long-term prosperity. Understanding the concept, mechanics, benefits, and risks involved is key to implementing this strategy effectively. By following the strategies outlined in this article and seeking professional advice, individuals can make smart money moves that lead to financial growth and security.